Risk means uncertainty.

Death is certain, none of us can claim to be immortal. However, untimely death is a risk.

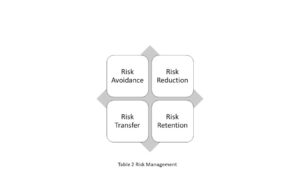

Not only is it an emotional risk for the family members to lose someone dear, it has financial implications which cannot be ignored. Therefore, Risk management comes into picture here. There are broadly speaking 4 ways to deal with a risk. We can either completely avoid it, but can death be avoided? Alternatively,one can Reduce the chances of it, meaning taking good care of health, being cautious in life, etc. One can also either Retain the risk, or transfer it.

In table 1 , Financial Risk is subdivided into Pure risk and Speculative here. Pure Risk refers to risks that are beyond human control with no possibility of financial gain. Speculative risk on the other hand is something that when undertaken, can either result in profit, loss, or no profit no loss.

In order to transfer the pure risk associated with death, or untimely death, we have Life Insurance. It is important to have a little background knowledge of risk to understand life insurance and why it is important.

I have come across many people who believe life insurance is a waste of money in the form of premiums, and that they are immune and nothing wrong can happen to them. As much as I would want that to be true and applaud their optimism, nothing in life is guaranteed. Anything can happen to anybody at any point of time. I mean, the entire world had come to a standstill and not a single person in any country was allowed to step out of their houses during the Covid-19 lockdown, could we have ever imagined this 5 years back? And yet we have endured it. Life insurance is a safety mechanism, is has been designed to provide financial security to the dependents in the absence of the breadwinner. if premium seems to be too expensive, it is advisable to start early. One can opt for Term life policies to cover untimely death, and premiums aren’t too high. One can also search for policies online and apply directly without an agent, thereby saving on some commission. I believe Insurance and investment should not be merged. Insurance and Investment are different and should stay that way, and therefore I personally do not support this idea. Life insurance is protective measure to support the dependents, the priority is simple. It should be like that.

Some believe that it a tool to save taxes. This is because the government knows the importance of life insurance. It does help in saving taxes, but taking an insurance policy with the sole objective to save on taxes is not a good idea. Please study the policies, understand the TC and opt for the one that is most relevant and can cover for the financial needs of the family members for some years. Prioritise this over saving taxes.

Life Insurance is taken with the intention to support the family of dependents in case if something happens to the policyholder. Having a policy only for the sake of having one, or due to peer pressure or because of relatives of family pressure will not only result in a bad decision, but many also end of not helping anyone. The ones left behind already will have to deal with the emotional distress, life insurance is for their benefit, please be kind and opt for one.

You’ve been great to me. Thank you!

I hope you liked the article.